Business Insurance in and around Kansas City

One of Kansas City’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Value!

Small business owners like you have a lot on your plate. From marketing guru to customer service rep, you do everything you can each day to make your business a success. Are you a plumber, a taxidermist or a hair stylist? Do you own a bridal shop, an interpreter or a photography business? Whatever you do, State Farm may have small business insurance to cover it.

One of Kansas City’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

When one is as committed to their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for commercial liability umbrella policies, surety and fidelity bonds, commercial auto, and more.

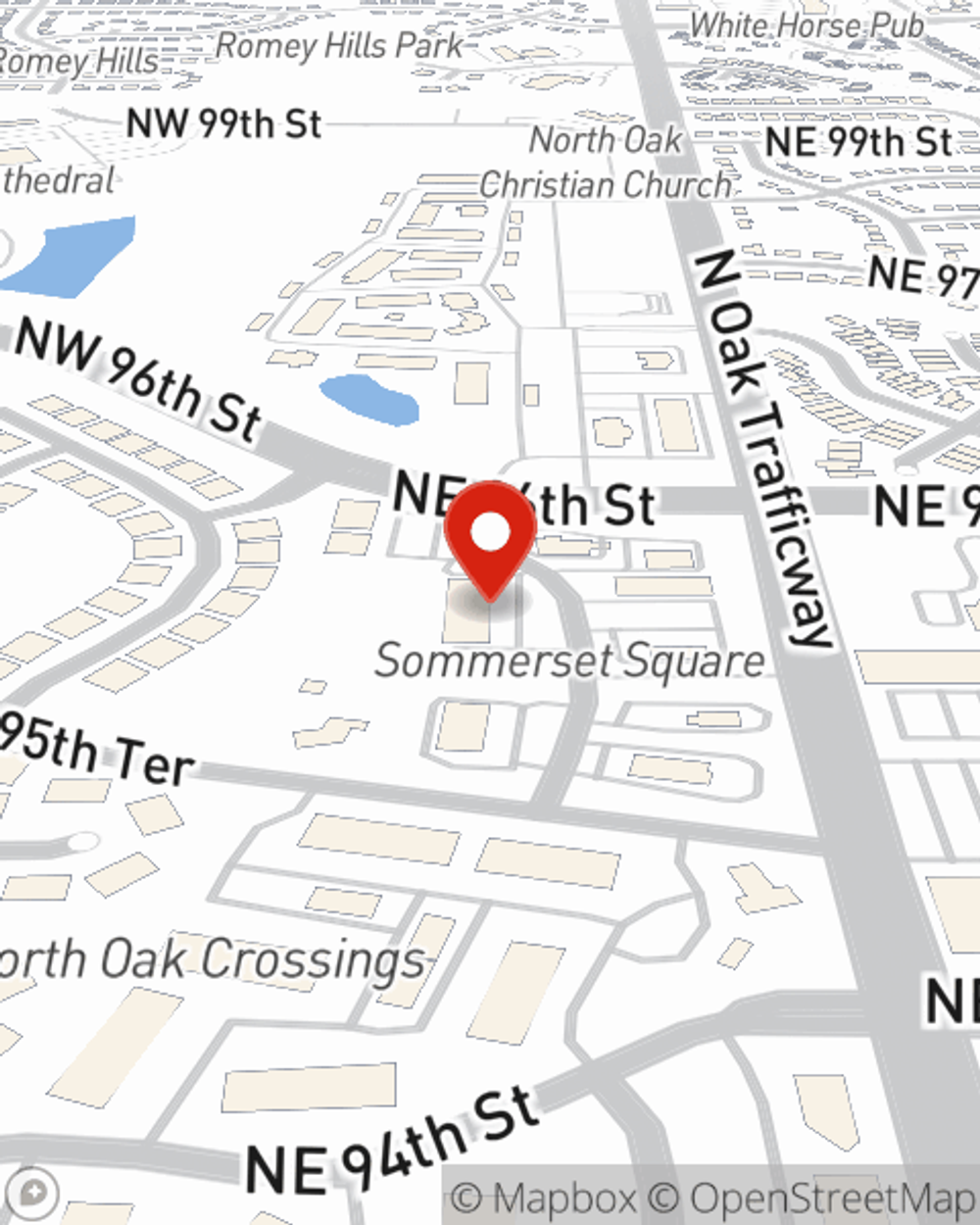

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Peter Fox is here to help you review your options. Reach out today!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Peter Fox

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.